The Experience of transnational corporations’ development in the conditions of world financial crisis

IntroductionThe actuality of the topic. Fifty-one of the largest one-hundred economies in the world are corporations. Transnational corporations hold ninety percent of all technology and product patents worldwide, and are involved in 70 percent of world trade. They employ in their foreign affiliates about 80 million people. The United Nations has justly described these corporations as “the productive core of the globalizing world economy.”

I.A. Karimov, the President of the Republic of Uzbekistan, had already marked that “The XXI st century, obviously, will be the century of globalization in the international relations. In these conditions, the process of integration, the expansion of participation of sovereign states at the international institutes and the organizations are to be considered not only as historical inevitability, but also as a powerful factor of stability”. No wonder, in any sphere it is impossible not to come across to the influence of globalization.

It is known that, currently, the world states, almost all of them, can’t ensure anymore a stable development and growth based only their own forces. World governments perceive that the deepening of relations between countries, and also the more active and effective involving and integrating in the global economic cycle is the key factor of economic prosperity. Unfortunately, not all states can act alone on the world arena, especially the small ones. Some countries need support from other states, more experienced, stronger and with greater financial strength.

The impact of globalization can be seen in any country’s national economy. It is tough to describe national economies, world economy without globalization. The volume of world economy grows steadily. According to World Trade Organization data, the volume of world trade has been growing much faster since 1950 than ever. During 1950-2000, world trade has grown 20 times and manufacture 6 times.

In the process of economic globalization, on the arena of international economic relations appear new actors. One of them is transnational corporations that move their capital from several countries of the world under the influence of different factors and create an economic chain through which are moving enormous innovations and financial flows.

Transnationalization of production, its expansion outside their home state, has a significant impact on national economies, establishing their place in the world work division.

However, parallel with the development of external economic relations, is changing the state's role and its functions. The state start to gain new functions, functions appearing as result of the states competition in the process of attracting foreign capital flows in the national economy.

Attracting transnational corporations in the national economy is today the main objective of the competition process between states. World states, especially smaller ones, in development or in transition, being enticed by the financial sources of TNCs, are involved in an increasingly fierce battle to attract the necessary capital in the country. Paradoxically, but eventually also TNCs are those which take advantage of it the most.

Thus, addressing the impact of this process needs to be done multilaterally, to find the optimum solution of how to attract foreign capital flows in the national economy at the present stage, focusing on their efficiency and quality.

In last decades a lot of attention is given to transnational corporations. Today there is nearly no considerable process in world economy which would occur without the participation of transnational corporations. The transnational corporations have turned to the ubiquitous force forming modern and future shape of the world. They accept direct and indirect participation in world political and economical process.

TNCs carry out their activity in world economy system, but their influence extends on world politics that allows to recognize TNCs along with the national states, the international organizations. TNCs are not absolutely new phenomenon, and represent the special form of display of general law of development of capitalism, aspiration of the capital to the external economic expansion in the form of direct foreign investments. The manufacture which is carried out abroad, has a number of advantages which follow from distinctions of political and economic conditions between the country - basing of the TNC and a host country where branches of TNCs settle down in this plan: degree of security and cost of extraction and processing of natural resources; rates of wages of work; the labor legislation; the taxation; exchange rate; ecological standards; a political mode; the political culture, etc. These distinctions increase maneuverability of the multinational corporation on a world scene.

The basic line of TNCs - global operations. Huge thing for TNCs is the world market. Therefore the expansion of TNC is carried out internationally.

From the very beginning of TNCs' existence became object of rough economic discussions. One their activity was estimated as destructive, the emphasize became on negative consequences of industrialization. Others attributed a role of the main tool of world progress.

70th years have passed under the sign of negative estimations for TNCs as a factor of an aggravation of economic, political and social contradictions.

In 80th years, appreciable role of the TNCs was observed in economic development and in the permission of political and social problems. Previously, it came with the recognition of their enormous potential, a huge role in development of scientific and technical progress.

However, economic growth of TNCs on the political and social value is ambiguous. From the economic point of view it conducts to the growth of productivity and labor force, escalating of capacities of the goods and services, manufacture and national income. On the other hand, typical line of "transnational economy" is strong contrast between large TNC and the country as a whole with serious difficulties: unstable development of manufacture, inflation, unemployment, etc. From the social point of view, economic growth of the transnational corporation increases vacancy for the unemployment and capital opposition. They arrange tough policy concerning employment. During economic crises TNCs even are inclined to the big reduction of the personnel that conducts to a condition of sharp confrontation with trade unions. In other cases - the transnational corporations, on the contrary, guide social intensity in a society.

The object of my work is the activity of transnational corporations in the world economy.

The subject – the tendency of TNCs’ development during the world financial crisis.

The purpose of the given work - to consider the tendencies of TNCs’ development in the conditions of world financial crisis in modern international economic relations.

For this purpose it is necessary to allocate following themain tasks:

1. To open the concept and essence of the transnational corporation;

2. To define the role of transnational corporations in globalization;

3. The impact of world financial crisis to the activity of the activities of transnational corporations;

4. The reaction of TNCs to crisis.

1. THEORETICAL BASIS OF TRANSNATIONAL CORPORATIONS

1.1 The concept of transnational corporation, history of their development

The exact standard definition of the transnational corporation does not exist till now. Terminological diversity of the concept both in English-speaking (or Uzbek), and in the foreign literature remains. It can be seen in various variants of word combinations - a corporation, a company, an enterprise, a firm in a combination with adjectives - transnational, multinational, international, global etc. This terminological diversity of natural, because it reflects the attempt to find an adequate reflection of the new features that are in the field of international economic relations have gained this monopoly. Transnational corporations are basically “national” on the capital and “international” on the field of activity. The part "trans" emphasizes this quality - the border crossing of goods and capital flows. I will give several definitions for TNC:

Transnational corporations (TNCs) are incorporated or unincorporated enterprises comprising parent enterprises and their foreign affiliates. A parent enterprise is defined as an enterprise that controls assets of other entities in countries other than its home country, usually by owning a certain equity capital stake. An equity capital stake of 10% or more of the ordinary shares or voting power for an incorporated enterprise, or its equivalent for an unincorporated enterprise, is normally considered as the threshold for the control of assets. (In some countries, an equity stake of other than 10% is still used.

Transnational corporation (TNC) - a monopoly union (concerns or multinational corporations), in which many companies are combined with one or more branches of the world economy, which are engaged in manufacturing and trading activities that transcend national countries.

TNC - a company (financial-industrial groups), which owned or controlled by complexes of production or service outside of the country in which these corporations are based, have an extensive network of branches and subsidiaries in different countries and occupy a leading position in production and sales of a product.

Transnational corporation - the kind of form of the international association of capitals when the parent company has affiliates in many countries, carrying out coordination and integration of their activity.

The legal regime of TNCs suggests business activity in different countries through the formation of branches and subsidiaries. These companies have a relatively independent service production and marketing of finished products, research and development, services to consumers, etc. In general, they comprise a large single production complex ownership over the equity only representatives of the country's founding. At the same time, branches and subsidiaries can be mixed enterprises with the participation of mainly national home country.

Distinctive lines of the transnational corporation are:

1) annual turnover is usually higher than $ 100 million;

2) have branches in more than 6 countries;

3) on the international status of the firm shows an indicator such as size percent of its sales, its products sold outside the country of origin of the company;

4) structure of its assets, in some foreign researches to the international corporations carry the companies having 25 % of actives abroad

The development of transnational corporations has passed historically a number of stages. In the first period of the origin of TNCs (the end of XIX century.), they have undergone very significant transformation. TNCs’ first generation has been largely associated with the development of raw materials of former colonies, which gives the basis to define them as «the national-raw transnational corporations».

According to its organizational and economic forms and mechanisms of functioning, there were cartels, syndicates and the first trusts. Then on the world stage there were trust types of TNCs which were associated with the production of military-technical products. Having started its activity in the period between two world wars, some of those second generation TNCs maintained their position in the global economy and after World War II. They produced weapons and ammunition.

In the 60th years, an increasingly prominent role of TNCs has begun to play the third generation, which was widely used to achieve scientific and technological revolution. These techno-consumer companies: corporations and conglomerates.

In the 60 – 80th years in the activity of TNCs organically incorporated the elements of national and foreign production: realizations of goods, management and organization of personnel, research of marketing and after-sales service.

The third generation of transnational corporations promoted to spread the achievements of scientific and technological revolution in the peripheral areas of the world economy and, most importantly, economic preconditions for the occurrence of international production with a single market and the information space, the international capital market and labor, scientific and technical services. Their goal was to conquer markets, sources of raw materials and spheres of application of capital.

In the early 60's the global transnational corporations of the fourth generation have gradually appeared and have affirmed. Their distinguishing features are:

· planetary vision of the markets and implementation of competition on a global scale, section of the world markets with a few global multinational corporations;

· coordinate the actions of their affiliates on the basis of new information technologies;

· flexible organization of each production site, adaptability corporate structure, uniform accounting and auditing;

· integration of its subsidiaries, factories and joint ventures into a single global network management, which, is integrated with other networks of TNCs

· implementation of economic and political influence in the state in which they operate TNCs.

Their strategy is characterized by their innovative aggressiveness, dynamism and a withdrawal from single industry structure, constant improvement of internal corporate structure, aiming at the conquest of the key global economic position in the production and marketing.

As for the structure of transnational corporations, it is following:

A parent company is an incorporated or unincorporated enterprise, or group of enterprises, which has a direct investment enterprise operating in a country other than that of the parent enterprise. An affiliate enterprise is an incorporated or unincorporated enterprise in which a foreign investor has an effective voice in management. Such an enterprise may be a subsidiary, associate or branch.

A subsidiary (an affiliate) is an incorporated enterprise in the host country in which another entity directly owns more than a half of the shareholder's voting power, and has the right to appoint or remove a majority of the members of the administrative, management or supervisory body.

An associate is an incorporated enterprise in the host country in which an investor owns a total of at least 10%, but not more than half, of the shareholders’ voting power.

A branch is a wholly or jointly owned unincorporated enterprise in the host country which is one of the following: a permanent establishment or office of the foreign investor; an unincorporated partnership or joint venture between the foreign direct investor and one or more third parties; land, structures (except structures owned by government entities), and /or immovable equipment and objects directly owned by a foreign resident; or mobile equipment (such as ships, aircraft, gas- or oil-drilling rigs) operating within a country, other than that of the foreign investor, for at least one year.

A joint venture involves share-holding in a business entity having the following characteristics: the entity was established by a contractual arrangement (usually in writing) whereby two or more parties have contributed resources towards the business undertaking; the parties have joint control over one or more activities carried out according to the terms of the arrangements and none of the individual investors is in a position to control the venture unilaterally.

1.2 The evolution of a Transnational Corporation

Economists did not actually coin the phrase “transnational corporation” until the 1960s. Even before that time, however, studies were being conducted into the history and evolution of transnational corporation organization. When these studies were finally executed, it was shown that TNCs had different internal organizational structures based on geographic location—even at their earliest stages in development. The growing role of transnational corporations (TNCs) in the world economy began to speak only in the second half of XX century. The uncontrolled activities of transnational corporations are main key reasons for the imbalances in the global economy. In general, there are five stages in the evolution of the transnational corporation. These stages describe significant differences in the strategy, worldview, orientation, and practice of companies operating in more than one country. One of the key differences in companies at these different stages is in orientation.

Stage One—Domestic

The stage-one company is domestic in its focus, vision, and operations. Its orientation is ethnocentric. This company focuses upon domestic markets, domestic suppliers, and domestic competitors. The environmental scanning of the stage-one company is limited to the domestic, familiar, home-country environment. The unconscious motto of a stage-one company is: “If it’s not happening in the home country, it’s not happening.” The world’s graveyard of defunct companies is littered with stage-one companies that were sunk by the Titanic syndrome: the belief, often unconscious but frequently a conscious conviction, that they were unsinkable and invincible on their own home turf.

The pure stage-one company is not conscious of its domestic orientation. The company operates domestically because it never considers the alternative of going international. The growing stage-one company will, when it reaches growth limits in its primary market, diversify into new markets, products, and technologies instead of focusing on penetrating international markets.

Stage Two—International

The stage-two company extends marketing, manufacturing, and other activity outside the home country. When a company decides to pursue opportunities outside the home country, it has evolved into the stage-two category. In spite of its pursuit of foreign business opportunities, the stage-two company remains ethnocentric, or home country oriented, in its basic orientation. The hallmark of the stage-two company is the belief that the home-country ways of doing business, people, practices, values, and products are superior to those found elsewhere in the world. The focus of the stage-two company is on the home-country market.

Because there are few, if any, people in the stage-two company with international experience, it typically relies on an international division structure where people with international interest and experience can be grouped to focus on international opportunities. The marketing strategy of the stage-two company is extension; that is, products, advertising, promotion, pricing, and business practices developed for the home-country market are “extended” into markets around the world.

Almost every company begins its global development as a stage-two international company. Stage two is a natural progression. Given limited resources and experience, companies must focus on what they do best. When a company decides to go international, it makes sense at the beginning to extend as much of the business and marketing mix (product, price, promotion, and place or channels of distribution) as possible so that learning can focus on how to do business in foreign countries.

A fundamental strategic maxim is that it is a mistake to attempt to simultaneously diversify into new customer and new-product/technology markets.

The international strategist observes this maxim by holding the marketing mix constant while adding new geographic or country markets. The focus of the international company is on extending the home-country marketing mix and business model.

Stage Three—Multinational

In time, the stage-two company discovers that differences in markets around the world demand an adaptation of its marketing mix in order to succeed. Toyota, for example, discovered the former when it entered the U.S. market in 1957 with its Toyopet. The Toyopet was not a big hit: Critics said they were “overpriced, underpowered, and built like tanks.” The car was so unsuited for the U.S. market that unsold models were shipped back to Japan. The market rejection of the Toyopet was chalked up by Toyota as a learning experience and a source of invaluable intelligence about market preferences. Note that Toyota did not define the experience as a failure. There is, for the emerging global company, no such thing as failure: only learning experiences and successes in the constantly evolving strategy and experience of the company.

When a company decides to respond to market differences, it evolves into a stage-three multinational that pursues a multi-domestic strategy. The focus of the stage-three company is multinational or in strategic terms, multi- domestic. (That is, this company formulates a unique strategy for each country in which it conducts business.) The orientation of this company shifts from ethnocentric to polycentric.

A polycentric orientation is the assumption that markets and ways of doing business around the world are so unique that the only way to succeed internationally is to adapt to the different aspects of each national market. Like the stage-two international, the stage-three multinational, polycentric company is also predictable. In stage-three companies, each foreign subsidiary is managed as if it were an independent city-state. The subsidiaries are part of an area structure in which each country is part of a regional organization that reports to world headquarters. The stage-three marketing strategy is an adaptation of the domestic marketing mix to meet foreign preferences and practices.

Philips and its Japanese competition was dramatic. Matsushita, for example, adopted a global strategy that focused its resources on serving a world market for home entertainment products.

Stage Four—Global

The stage-four company makes a major strategic departure from the stage-three multinational. The global company will have either a global marketing strategy or a global sourcing strategy, but not both. It will either focus on global markets and source from the home or a single country to supply these markets, or it will focus on the domestic market and source from the world to supply its domestic channels. Examples of the stage-four global company are Harley Davidson and the Gap. Harley is an example of a global marketing company. Harley designs and manufactures super heavyweight motorcycles in the United States and targets world markets. The key engineering and manufacturing assets are all located in the home country (the United States). The only Harley investment outside the home country is in marketing. The Gap is an example of a global sourcing company. The Gap sources worldwide for product to supply its U.S. retail organization. Each of these companies is operating globally, but neither of them is seeking to globalize all of the key organization functions.

The stage-four global company strategy is a winning strategy if a company can create competitive advantage by limiting its globalization of the value chain. Harley Davidson gains competitive advantage because it is American designed and made, just as BMW and Mercedes have traded on their German design and manufacture. The Gap understands the U.S. consumer and is creating competitive advantage by focusing on market expansion in the United States while at the same time taking advantage of its ability to source globally for product suppliers.

Stage Five—Transnational

The stage-five company is geocentric in its orientation: It recognizes similarities and differences and adopts a worldview. This is the company that thinks globally and acts locally. It adopts a global strategy allowing it to minimize adaptation in countries to that which will actually add value to the country customer. This company does not adapt for the sake of adaptation. It only adapts to add value to its offer. It should be noted strengthening the transnational nature of the consolidation, accompanied by the growth of global multinationals.

The key assets of the transnational are dispersed, interdependent, and specialized. Take R&D, for example. R&D in the transnational is dispersed to more than one country. The R&D activities in each country are specialized and integrated in a global R&D plan. The same is true of manufacturing. Key assets are dispersed, interdependent, and specialized. Caterpillar is a good example. Cat manufactures in many countries and assembles in many countries. Components from specialized production facilities in different countries are shipped to assembly locations for assembly and then shipped to customers in world markets.

Shortly, the concept of TNC has gradually moved from international mentality to a multinational, then to the global and finally transnational mentality.

1.3 Classification of TNCs

A variety of TNCs which operate in the world can be classified into a number of signs. The cores from them: the country of origin, industry focus, size, the level of transnationalization.

The practical significance of the classification of TNCs is that it allows for more objectively estimating the advantages and disadvantages of placing specific corporations in a host country.

Country of Origin Country of origin is determined by the nationality of TNCs in the capital of its controlling stake assets. Usually, it coincides with the nationality of the country-based head company of the corporation. In the developed countries TNCs are considered as a private capital. However in the developing countries, the capital structure of some (sometimes large) part of TNCs may belong to the state. This is due to the fact that they were created on the basis of the nationalized foreign-owned or state-owned enterprises. Their goal was not into the economies of other countries, but their main purpose was to lift national economy.

Commodity Focus The global product is one approach to TNC organization. This is assigned worldwide responsibility for specific products or product groups in order to separate operating divisions within a firm. It means, what to produce for transnational corporations is really crucial. Commodity Focus TNC is defined by the basic sphere of its activity. On this basis, it is distinguished with TNCs which are adapted for raw materials, the corporations which are engaged in basic and secondary manufacturing industries and industrial conglomerates. Currently, multinational corporations maintain their position in the basic branches of mining and manufacturing industries. These are the areas of activity that require substantial investment. In the last years, more than 250 from the list of 500 largest transnational corporations in the world are operating in such areas as electronics, computers, communications equipment, food, beverages and tobacco, pharmaceutical and cosmetic products, as well as in the service of commercial services, including on the Internet.

Transnational corporations carry out various kinds of overseas research and development work: adaptive, ranging from basic support processes and ending with the modification and improvement of imported technologies, innovation associated with the development of new products or processes for local, regional and global markets and others.

The choice of the type of R & D (Research and Development) and industry specialization depend on what region, on what level of development there is a host country. For example, in Southeast Asia is dominated with innovative R & D associated with computers and electronics, in India - with the sector of services (especially software), in Brazil and Mexico - with the production of chemicals and transport equipment.

For transnational corporations, conglomeratic type with a view of definition of their specialization is called branch A, which the UN describes as having a considerable amount of foreign assets, the greatest quantity of foreign sales and the largest number of workers abroad. The largest part of corporation’s investment goes to this branch, and proportionally, it gives the greatest profit for corporation.

The size of transnational corporations

Symptom classification, which is usually determined by the method of UNCTAD, is defined by the size of their foreign assets. This parameter is especially used for the diversification of the largest TNCs, large, medium and small. In order to get the name large one, assets of transnational corporation should exceed 10 billion dollars.

The vast majority of the total number of TNCs (90%) belongs to medium and small corporations. According to the UN classification these include companies with fewer than 500 employees in the country of residence. In practice there are multinational corporations with total of employees less than 50 persons. The advantage of small TNCs is their ability which adapts more quickly to changing market conditions.

2. THE ROLE OF TRANSNATIONAL CORPORATIONS IN MODERN ECONOMIC RELATIONS

2.1 TNC participation in international production

The economic and financial crisis has significantly affected TNCs’ operations abroad. Foreign affiliate’ sales and value-added declined by 4-6 percent in 2008 and 2009. Since this contraction was slower than the decline of world economic activity, however, the share of foreign affiliates’ value-added (gross product) reached a new historic high of 11 percent of world domestic product (GDP). Besides Greenfield investments, any expansion of the foreign operations of TNCs in 2009 can largely be attributed to the organic growth of existing foreign affiliates.

The world market is becoming more and more integrated. Within last ten years world trade developed much faster than world production grew. Foreign employment remained practically unchanged in 2009 (+1.1 percent). This relative resilience might be explained by the fact that foreign sales started to pick up again in the latter half of 2009. In addition, many TNCs are thought to have slowed their downsizing programmes as economic activity rebounded – especially in developing Asia. In spite of the setback in 2008 and 2009, an estimated 80 million workers were employed in TNCs’ foreign affiliates in 2009, accounting for about 4 percent of the global workforce.

Dynamics vary across countries and sectors, but employment in foreign affiliates has been shifting from developed to developing countries over the past few years; the majority of foreign affiliates’ employment is now located in developing economies. The largest number of foreign-affiliate employees is now in China (with 16 million workers in 2008, accounting for some 20 percent of the world’s total employees in foreign affiliates). Employment in foreign affiliates in the United States, on the other hand, shrank by half a million between 2001 and 2008.

In addition, the share of foreign affiliates’ employment in manufacturing has declined in favor of services. In developed countries, employment in foreign affiliates in the manufacturing sector dropped sharply between 1999 and 2007, while in services it gained importance as a result of structural changes in the economies.

Foreign affiliates’ assets grew at a rate of 7,5 percent in 2009. The increase is largely attributable to the 15 percent rise in inward FDI stock due to a significant rebound on the global stock markets.

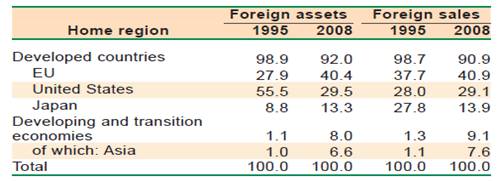

The regional shift in international production is also reflected in the TNC landscape. Although the composition of the world’s top 100 TNCs confirms that share has been slowly decreasing over the years. Developing and transition-economy TNCs now occupy seven positions among the top 100. And while more than 90 percent of all TNCs were headquartered in developed countries in the early 1990s, parent TNCs from developing transition economies accounted for more than a quarter of the 82,000 TNCs (28 percent) worldwide in 2008(2.1- table), a share that was still two percentage points higher than that in 2006, the year before the crisis. As a result, TNCs headquartered in developing and transition economies now account for nearly one tenth of the foreign sales and foreign assets of the top 5,000 TNCs in the world, compared to only 1-2 percent in 1995(2.1-picture).

Picture 2.1 - Number of TNCs from developed countries and from developing and transition economies, 1992, 2000 and 2008

Other sources point to an even larger presence of firms from developing and transition economies among the top global TNCs. The Financial Times, for instance, includes 124 companies from developing and transition economies in the top 500 largest firms in the world, and 18 in the top 100. Fortune ranks 85 companies from developing and transition economies in the top 500 largest global corporations, and 15 in the top 100.

Table 2.1 - Foreign activities of the top 5,000 TNCs, by home region/country, 1995 and 2008

Over the past 20 years, TNCs from both developed and developing countries have expanded their activities abroad at a faster than at home. This has been sustained by new countries and industries opening up to FDI, greater economic cooperation, privatizations, improvements in transport and telecommunications infrastructure, and the growing availability of financial resources for FDI, especially for cross-border M&As.

The internationalization of the largest TNCs worldwide, as measured by the transnationality index, actually grew during the crisis, rising by 1.0 percentage points to 63, as compared to 2007. The transnationality index of the top 100 non-financial TNCs from developing and transition economies, however, dropped in 2008. This is due to the fact that in spite of the rapid growth of their foreign activities, they experienced even faster growth in their home countries. Among both groups, this index varies by region: TNCs based in the EU, Africa, and South Asia are among the most transnationalized.

2.2 TNCs’ role in mobilizing financial resources and the impact on investment

Globalizing is shrinking deeply day by day because of some reasons. As an example we can refer to foreign direct investment. Foreign direct investment inflows globally continued to rise by 30% in 2007: at $1,833 billion, they reached a new record level. It must be mentioned, that previous all-time high set was reached in 2000. It is also said, that the financial and credit crisis, which began to affect several economies in late 2007, did not have a significant impact on the volume of FDI inflows that year, but it has added new uncertainties and risks to the world economy. Therefore, this might have a dampening effect on global FDI in 2008-2009. Following table shows the tendency of foreign direct investment. Undoubtedly, the impact of transnational corporations increases in the world economy respectively with foreign direct investment.

Direct investments’ volume is becoming higher year by year.(2.2-table) As we know transnational corporations are main source of direct investment. That’s why, we are able to say that the role and impact of TNCs in the world economy tend to grow in future.

Table 2.2 - Possible growth direct investments’ volume

| Level | 1990-year | 2000-year | 2005-year | 2010-year | 2015-year | 2020-year |

| Minimum | - | - | - | 1070 | 1540 | 2055 |

| Average | 258,0 | 1200,8 | 778,7 | 1125 | 1626 | 2350 |

| Maximum | - | - | - | 1180 | 1715 | 2420 |

Expanding and upgrading infrastructure in keeping with developing countries’ growing requirements calls for substantial investment in infrastructure industries, which are typically capital-intensive due to the physical facilities and networks that they involve. Many projects are very large and are characterized by economies of scale. They require huge capital outlays, while the stream of returns on capital is spread over many years. Thus the risks to investors are typically high. Mobilizing the necessary financial resources from domestic or international capital markets is difficult for public or private enterprises in many developing countries. This has led a number of countries to open up to FDI and/or encourage other modes of TNC involvement, such as build-own-operate (BOO), build-own-transfer (BOT) or rehabilitate-own-transfer (ROT) concession arrangements. Indeed, TNCs may have a number of competitive advantages that enable them to contribute to the mobilization of financial resources for boosting investment in infrastructure industries, while also being directly involved in undertaking the investments and production activities for the provision of infrastructure services.

Financial strength and large cash flows are competitive advantages that foster rapid expansion of many TNCs operating in infrastructure. In addition, large and well-established firms are able to raise funds from home-country and international markets as well as from host developing-country markets, where the latter exist. This ability to mobilize and harness external financial resources for investment is particularly evident in concessions such as BOTs, in which a high proportion of the costs are covered by debt. However, the extent to which TNCs can contribute to financial resources for investment in infrastructure also depends on host-country conditions and objectives, the specific infrastructure needs of a country and the gaps in domestic (State and private) resources and capabilities.

In the early 1990s, as more and more developing countries began to open up their infrastructure industries to private national and foreign companies, it was believed that TNCs could play a key role in securing financial resources to reduce the persistent gap between infrastructure needs and investments by the State, which was the main provider of the services. At the time, many of the countries concerned, especially in Latin America and Africa, were heavily indebted and turned to the private sector, including TNCs. Since then, the financial situation has improved for some economies, but the investment gap in infrastructure still remains very large in the developing world as a whole. Thus the ability of TNCs to mobilize financial resources for investment remains an important consideration for many countries. Indeed, TNC participation in infrastructure in developing countries has resulted in the inflow of substantial financial resources. One indicator, allowing for data limitations, is the stock of infrastructure FDI in developing countries, which surged 29-fold between 1990 and 2006: from $6.8 billion to $199.4 billion. Another measure, the foreign investment commitments in private participation in infrastructure (PPI) projects (which include FDI, but also other investments that are an element of concessions), also indicates that TNCs have mobilized significant resources for investment in developing countries. During the period 1996–2006 such commitments amounted to about $246 billion. The impact on infrastructure investment in developing countries arising from this mobilization of financial resources by TNCs is discussed below, including variations by region, industry and country.

Overall impact of TNC involvement on infrastructure investment in developing countries. Not all financial resources mobilized by TNCs constitute investment or an addition to productive assets for a host industry or country. One reason is that a proportion of FDI by TNCs is used to purchase privatized enterprises, which represents a transfer of ownership, but not new capital stock. But at the same time other forms of TNC participation also include investment. This is especially true of concessions, which involve large amounts of investment to build new or improve existing infrastructure. During the period 1996–2006, according to data on the breakdown of foreign investment commitments (referred to in the discussion below as TNC commitments), 52% of TNC participation, by value, in the infrastructure industries of developing countries was in the form of FDI, while the remaining 48% was in the form of concessions. This nearly equal ratio of concessions to FDI implies a possibly greater overall impact on investment in infrastructure industries than that suggested by data on the stock of FDI. Because some relevant data are not available, it is not possible to give a precise figure for the impact of TNCs, but it is certainly appreciable and likely to be higher than that suggested by FDI data alone.

In addition to their direct impact on investment, the entry and operations of TNCs can indirectly influence investment levels in host country infrastructure industries through their effects on investments of domestic firms – whether state-owned enterprises or private enterprises. These effects can vary: TNC involvement may “crowd in” other investors; or an increase in the competitive advantages of domestic enterprises through diffusion of technology and other know how from TNC operations may enable them to invest in new areas; or, taxes paid by TNCs could potentially be used for further infrastructure investments by the State. On the other hand, a fall in investment levels might occur from the “crowding-out” of investors, for example because of competition, when domestic enterprises are still at an early stage of development or due to anti-competitive behavior by TNCs.

A consequence of investment in infrastructure by foreign companies in the 1990s was a decline in public investment in the sector across much of Latin America and parts of Africa. In expectation of a large-scale increase in private sector investment, many governments in Latin America – faced with persistent budgetary gaps – cut back drastically on public expenditure in infrastructure in the early 1990s. Between 1980–1985 and 1996–2001, total expenditure on infrastructure investment in seven major Latin American economies taken together declined from a weighted average of 3.7% of GDP to 2.2%, even though private investment (primarily by TNCs) in the industries actually rose from 0.6% to 1.4% of GDP, albeit with considerable differences between countries. An important lesson from the Latin American experience is that TNC participation should not be considered sufficient to meet a country’s investment needs in infrastructure; rather, it should be viewed as an important supplement and complement to domestic investment. Developing countries should therefore strengthen and improve the capabilities of their State-owned enterprises (where these continue to play a role), while at the same time encouraging their domestic private sector to develop the necessary expertise and financial capabilities to participate effectively in infrastructure industries.

Variations in the impact of TNC involvement on investment, by industry, region and country. As mentioned earlier, investments by TNCs in infrastructure projects in developing countries amounted to $246 billion during the period 1996– 2006, or an average of 28.5% of total investment commitments. This share indicates an appreciable contribution by TNCs to infrastructure investment in developing countries, as a whole. Differences exist in the degree of TNCs’ impact on the level of investments by industry, region and country, judging from the variations in the shares of TNCs in total private sector infrastructure investment commitments.

By infrastructure industry, TNCs’ shares in PPI(private participation in infrastructure) investment commitments during the period 1996– 2006, were highest in telecommunications (35.2%) and electricity (30.0%) and lowest in water (25.2%) and transport (19.3%). Apart from this, according to the World Bank’s PPI database, other notable variations included: a significant drop in the share of TNCs in energy investments in South Asia between 1996–2000 and 2001–2006, primarily reflecting difficulties faced by India in realizing its strategy towards attracting infrastructure TNCs; a decline in TNC participation in the telecommunications industry in East Asia and South-East Asia and Latin America and the Caribbean during the period 2001– 2006, reflecting the growing strength of domestic companies in these regions very large swings in TNC investment commitments in transport in nearly all regions between 1996–2000 and 2001–2006, possibly reflecting developments in a number of the sub-industries involved; and increases in TNCs’ share in overall private investment commitments in water in some regions and sub regions between 1996–2000 and 2001–2006, reflecting the efforts of countries to improve access to safe, clean water for their populations.

Regionally, the share of TNCs in total PPI commitments ranged from 19.8% in Asia in 1996– 2006 (with the lowest share in South Asia and highest in West Asia) to 35.5% in Africa and 33.3% in Latin America and the Caribbean. The variation in the share of TNCs in PPI investment commitments during the period 1996–2006 was even greater by country, with 75% of economies (out of 105 for which data are available) indicating a share above the overall average of 28.5%. The overall average share is low because a number of countries with large total investment commitments have below-average figures for the share of TNCs in these commitments, including Brazil, China, India, Malaysia, Mexico and

South Africa.

In a large number of countries the share of TNCs in total PPI investment commitments is significant: between 28% and 50%; and in a number of them the share is even higher, in the 50%–75% range. Furthermore, for nearly one fifth of countries (20) TNCs’ share in total private sector investment commitments is 75% or more. This group includes 13 least developed countries, among them Burundi, Chad, Guinea-Bissau, Haiti, Maldives, Samoa and Sudan.Their high share of TNC participation implies that for many least developed countries TNCs are more or less the private infrastructure sector.

2.3 The influence of transnational corporations on labor force migration

In the debates on the influence of transnationalization, savants and experts concluded long ago that this phenomenon is not purely economic, which is limited only to the reorganization of production activities and movement of capital flows. Globalization is a process of large-scale that produces effects in several areas such as politics, finances, trade, defense system, demography, ecology. Academics consider that the world has now become "a global city."

Transnationalization, in compared aspect, still can be viewed as migration process. Putting capital in other regions of the world, necessarily involves staff migration. Transnational corporations favors the meeting of the labor force with capital, making the movement of labor towards capital or transferring capital to areas with labor force surplus.

Usually, foreign direct investment is placed in the long term and requires interaction with various groups of econo0mic agents, starting with suppliers and ending with officials. Investors need to know the consumer, labor force and raw materials markets, regulations and laws governing their activities. Informational and contractual problems can often be very hard, so legal rules remain to be the most important determinant of FDI flows in one state.

The history of labor migration knows more than 100 years. Since the mid-nineteenth century were observed in many migration flows from European countries to the U.S., especially during economic conjuncture overseas. The second wave of migration into the U.S. from different countries was in the years '20-50, XX century, and then followed the migration from Mexico, the Caribbean etc.

Experts consider that the first attractive center for foreign labor force has been South Africa, which since the '50s drew cheap labor force from neighboring countries. In the period 1950-1970 takes place the accelerated development of peripheral global regions industrialization, which later achieved positive results in industrial development, becoming leaders in chapter - exports. They relate to Latin America, South African, Middle East and Southeast Asia. Obtaining independence of many African countries boost this process. Active penetration of international corporations in South Africa from Europe and the U.S. in the '70s, led to increased migration of labor force in this area. During this time it began to form the international center of attracting labor force from another continent, in South America, in the composition of some of the more developed countries like Argentina, Brazil, Mexico and Venezuela. Simultaneously, in these countries annually comes a large workforce from some of the least developed countries and from African and Asian countries. The interest of the Middle East for the labor force is related to the development of the oil industry from the '70s. In the late '70s, Saudi Arabia, Oman, Kuwait, UAE, worked over 3 million foreign workers and specialists from neighboring Arab countries, India, Pakistan and South Korea.

In the last decade has been formed a new regional center of attraction of labor force - South-East Asia. Starting with the '70, here takes place a process of accelerating the country's industrial development and internationalization of economic life in this giant region, influenced by massive foreign investment. An important role in these processes went to different transnational corporations from different national origin: American, Japanese, Australian, South Korean, etc.

The main feedback of the process of migration is the migrant’s remittances. They represent their financial sources, delivered in the origin countries. In 2002, migrant remittances constituted about 79 billion dollars. This amount is more than the sum of all development aid provided by the states of the world and about 40% of total FDI in developing countries.

The use of foreign labor force, in present, becomes an important part of normal and efficient operation of the world economy mechanism. Transnational corporations (TNCs), being the main driver of globalization, acts in a global economy that relates to global production, global capital, global market.

TNCs are the best bet people can work and earn money. Leaders are cooperating in an effort to bring about real reform in a way that was unthinkable a few years ago. They deserve the world’s energetic support. Therefore, lots of host countries as can as possible try to attract in order to allocate affiliates of large transnational corporations in their countries, because of huge vacancy for the unemployment by TNCs.

The main reason leading companies to internationalize their assets are: achieving higher profits with low costs and of enhanced profitability. This can be achieved by exploiting opportunities offered by other countries with cheaper raw materials and human resources, by the penetration of more advantageous markets for export. Not at least, among the positive effects of capital and technology exports are repatriating their earnings as profit in the origin countries of TNCs.

However, many scientists try to show the dependence between migration and trade. They say that determining the volume of trade without taking into account migration, it is not objective. Testing in some small economies shows that there is dependency between export and migration.

The practice of international labor migration has emerged as a spontaneous phenomenon but, with the development and intensification of the process, began to be regulated by the state. However, currently are not liquidated all features of this process.

The last decade of the XX century is characterized by the fact that importing countries and exporting countries of labor force introduce radical correction in their migration policy. As world practice shows, workers migration provides indisputable advantages to the countries: for those providing employment as for those who receive it.

For the control of migration processes, states have begun to introduce so-called migration rates. Labor force - importing states, taking into account the real needs and labor market situation, determine the number of labor resources to be imported.

The goal of migration policy of the exporting countries is that labor force migration should increase the reduction of unemployment, receipt of foreign funds from immigrant workers, i.e. remittances, which is used for balancing imports - export operations. But sometimes, there may appear acute economic and social problems. Positive consequences of labor force migration:

- settling the problem of unemployment;

- the emergence of additional sources of income from migrants for exporting countries;

- obtaining the knowledge and experience by the immigrants;

- investment income of immigrants in small business, favoring the opening of new jobs.

Negative consequences of immigration workers:

- the trend of increase in consumption funds obtained abroad.

- the tendency to hide income;

- "brainwashing".

- decrease the qualification of unemployed immigrants.

- However, both for countries of origin as for TNCs host countries, in addition to the earnings of the process of globalization, there are also losses. The transfer to other countries of a part of the assets of TNCs contributes to job losses and rising unemployment in countries of origin. Moreover, labor productivity growth through technology transfer, information, innovation in firms purchased by foreign investors, brings with it an increase in unemployment in the host countries, in particular for unskilled or low skilled labor force. Host countries are frustrated that research and development operations are in countries of origin of TNCs, and technological innovations aren’t implemented simultaneously in the host countries.

- Workforce in developing countries means, for industrial countries, providing some branches and infrastructure with needed workers, without which it is impossible a normal industrial process, and sometimes normal everyday life. For example, in France, migrants make up 1/2 of total employment in construction, 1/3 - in the car industry, in Belgium - half of the miners, in Switzerland - 2/5 of the construction workers.

- As mentioned above, one of the key features of the process of globalization is the movement or free flow of capital. In addition, current global trade regime under WTO auspices provides unique possibilities for movement and reallocation off funds. Transnationalization of the world takes place differently in each country. Some countries have more foreign capital, others less. The trend that it is observed today is that where foreign capital is moving there will focus large flows of people.

- Even if corporations come in underdeveloped countries, they don’t offer great benefits to employees; on the contrary, they came just as attracted by low wages and slave pyramid style of local systems. Citizens of third world are seeking to reach the West, believing that they perform the same work more and will gain more money. Their surprise occurs when, once arrived in Europe, all companies have their production moved to countries where they originally came, now they must re-orientate or accept jobs below their qualifications.

Although the products are cheaper because they are performed in countries where production costs are minimal, this migration of labor force generates unemployment in developed countries and, therefore, the remaining unemployed have no money to buy products even so not cheap. Forbes magazine has published a study showing that Detroit will disappear in the next 20 years, this outsourcing and refurbishment made that unemployment in this city to be enormous, and now crime is at unimaginable odds. From a towering American city - king of the automobile production, with millions of habitants - now have left only 900 thousand people.

3. THE TENDENCIES OF TRANSNATIONAL CORPORATIONS’ DEVELOPMENT IN POST-CRISIS PERIOD

3.1 Modern tendency of TNCs’ development during the crisis

Today there are about 82,000 TNCs worldwide, with 810,000 foreign affiliates in the world. These companies play a major and growing role in the world economy. For instance, exports by foreign affiliates of TNCs are estimated to account for about one third of total world exports of goods and services. And the number of people employed by them worldwide, which has increased about fourfold since 1982, amounted to about 77 million in 2009 - more than double the total labor force of a country like Germany.

The largest TNCs contribute to a significant proportion of total international production by all TNCs, both in developed and developing economies. Over the three-year period 2007-2009, on average, the 100 largest non-financial TNCs accounted for 9%, 16% and 11%, respectively, of the estimated foreign assets, sales and employment of all TNCs in the world. They also accounted for about 4% of world GDP, a share which has remained relatively stable since 2000. This section analyses the major trends and recent developments with respect to the largest TNCs, and examines the impacts of the ongoing financial and economic crisis on these firms and their international activities.

Over the past 15 years, the largest TNCs have undergone a steady process of internationaliz