Creating Market Economy in Eastern Europe

Annual Paper

of “World Economies”

“Creating Market Economy in Eastern Europe”

ПРИМЕЧАНИЕ: Раздел 3 данной курсовой работы и имеет отношение только к нашей республике, просьба обратить на это внимание и для каждого конкретного случая его необходимо переделывать под свой регион.

Carried out

By nd year student

The Summary

Introduction

1. Meaning of market Economy and Tasks of the Transitions.

2. The Emergence of Market Economy in European countries.

2.1 . The Transition to a Market Economy.

2.2. Poland and Hungary as the best example of transition in the East Europe.

3. Moldova’s way to an open economy.

Conclusion.

Introduction

This paper is oriented toward the problems of transition and creating in countries of Eastern Europe, namely Poland, Hungary, all of which are attempting to make the transition under a democratic, parliamentary form of government.

The last new years have witnessed truly extraordinary events in the formally communist societies. Under newly established conditions of free speech and freedom of organization, communist principles of political and economic control have been widely repudiated, and communist governments have been swept aside, replaced by governments committed to democratic principles and a market economy. While in some countries and parts of countries former communist have not been decisively dislodged, in almost all cases communism has lost whatever remaining legitimacy it possessed, and it most of these societies the crucial economic issue has suddenly changed from reforming the socialist planning system by the introduction of market-like elements to moving to a market-economy with private ownership of most of society's assets.

There are several reasons why the task of designing this transition is fascinating, especially to economists.

First, the problem in new: no country prior to 1989 had ever abandoned the communist political and economic system.

Second, the experience to date indicates that countries attempting transition face a number of common problems and difficulties. While there are important differences in the inherited situations and the choices made by governments of these countries, the similarities in the problems they face and the difficulties they are encountering suggest that there is logic to the transition process.

Third, the absence of any close historical parallels and the limited experience economics in transition offer an opportunity and a challenge for development of normative transition scenarios. This turn out, however to be extraordinarily difficult to construct.

Finally, the problems are not waiting for annalists' solutions; decisions currently being made may lead to an evolution with irreversible consequences.

1. Meaning of Market Economy and the Tasks of the Transitions.

That economic system which brings together natural resources, labour supply and technology and which is principally privately owned and were government has to some extent always been involved in regulating and guiding the economy, has been referred to as "Market Economy". Yet, despite this history of government intervention, individuals in that country have always been able to choose for whom they will work and what they will buy.

Now 3 groups make decisions and it is their dynamic interaction that makes the economy operate. Consumers, producers and government make economic decisions on a daily basis, the primary force being between producers and consumers; hence, the market economy designation.

Consumers look for the best values for what they spend while producers seek the best price and profit from what they have to sell.

Government, at state and local levels, seeks to promote the public safety, provides social safety-net, ensures fair competition and also provides a range of services believed to be better performed by public rather include education, health service, the postal service road and railway system, social statistical reporting and, of course, national defense.

In this market economy system, economic forces are unfettered, supply and demands build up the price of goods and services. Entrepreneurs are free to develop their business unless they can provide goods or services of a quality and price to complete with others; they are driven from the market.

By and large, there are three kinds of business:

1) those started and managed personally by single entrepreneurs;

2) the partnership where two or more people share the risks and rewards of a business;

3) the corporation, there stock holders as owners can by or sell their shares at any time on the open market; this latter structure permits the amassing of large sums of money by combining investment, making possible large-scale enterprise.

Innovations in economic theory in the last two decades undoubtedly affect the way economists look at the transition problem and have probably made them more pessimistic about the ease with which it can be accomplished. Developments in transaction cost economics, the economics of information, the new institutional economics, and evolutionary approaches to economics have sensitized economists to the vital role that institutions play in economic process. One way of thinking about a successful market economy is that it is a set of convergent expectations in the population about how other people will behave; these expectations support an extremely elaborate division of labour or a high degree of specialization among individuals, organizations, and geographic areas.

In recent decades many economists have returned to the Schumpeterian view that the advantage of the market economy (relative to its alternatives) lies more in its facilitation of innovative activity than in its allocative efficiency.

The system of central planning is surely deficient in both respects but it is shortcomings seem to be much greater in the area of innovation than in allocative efficiency.

Another development in economics that has reduced the affractiveness of the large conception of market socialism is the increased attention paid to the motivation of government officials, both legislators and bureaucrats.

In the 1950's and 1960's, much of economic analysis was focused on market failures and government action to remedy these failures, under the implicit assumption that government officials would follow the rules laid down by the authorities. The analysis of the logic of collective action and the formation of interest groups the theory of rent-seeking behavior, and the study of the evolution of cooperation and norms have emphasized that government failure as well as market failure must be taken into consideration in designing institutions.

A vivid analogy stated by Vladimir Benachek of Charles University is that the socialist economics are at the top of a small hill (the planned economy), and they want to get to the top of a larger hill (the market economy). But in between the two hills is a valley, which may be both wide and deep. The analogy illustrates the point that the centrally planned economics did have a coherent economic system (i.e. they were at the top of their hill). One might add that the smaller hill was being eroded by the strengthening of special interest groups and was perhaps, settling due to the seismic rumblings that shattered the communist authority. The band of travelers must settle their differences, agree on a route, and avoid the pitfalls and chasms along the way.

Perhaps economic analysis can facilitate the journey by designing a bridge between the two hills. Given the absence of close historical parallels and the severe limitations of economic models of society it is clearly beyond the capacity of social engineers to draw up very precise plans for the bridge.

The Tasks of the Transitions

The list of activities which governments which governments must undertake in countries attempting the transition to a market economy is truly staggering. The list given here is designed to convey something of the enormity and complexity of the job. First, there is a group of activities related to creating a new set of rules:

1. Setting up the legal infrastructure for the private sector:

Commercial and contract low, antitrust and labour low, environmental and health regulations; rules regarding foreign partnerships and wholly foreign-owned companies; courts to settle disputes and enforce the laws.

2. Devising a system of taxation of the new private sector:

Defining accounting rules for taxation purposes, organizing an Internal Revenue Service to collect taxes from the private sector.

3. Devising the rules for the new financial sector:

Defining accounting rules for reporting business results to banks and investors; setting up a system of bank regulation.

4. Determining ownership rights to existing real property:

Devising laws relating to the transfer of property, and laws affecting landlord tenant relations; resolving the vexatious issue of restitution of property confiscated by communist governments.

5. Foreign exchange:

a) setting the rules under which private firms and individuals may esquire and sell foreign exchange and foreign goods;

b) setting the rules in the same area for the not-yet-privatized enterprises.

Next there are some tasks related to managing the:

6. Reforming prices:

Enterprises that have been privatized will presumably be largely free to set their own prices, but early on in the process, the demands of the government budget will require raising prices on many consumer goods that have been provided at prices for below cost.

7. Creating a safety net:

Setting up an emergency unemployment compensation scheme; targeting aid in kind or in cash to those threatened with severe hard ship by the reforms.

8. Stabilizing the macroeconomic:

Managing the government budget to avoid an excessive fiscal deficit and managing the total credit provided by the banking system.

Finally there are tasks related to privatization:

9. Small-scale privatization:

Releasing to the private sector trucks and buses, retail shops, restaurants, repair shops, warehouses, and other building space for economic activities; establishing the private right to purchase services from railroads, ports, and other enterprises which may remain in the public sector.

10. Large-scale privatization:

Transferring medium and large-scale enterprises to the private sector; managing the enterprises that have not yet been privatized.

An abstract Model of the Transition consist of three main phases:

Phase 1: The cabinet-level negative phase

In this phase members of the central government interact with nationally representative interest groups. The tasks are organized into two categories: they will determine the general institutional structure of society and set guidelines that will be used in phase 2 to assign each enterprise to one of many alternative "transition regimes".

Phase 2: The assigned phase

In this phase state-owned enterprises are matched with transition regimes. One can assume that each state-owned enterprise is completely described by some vector of attributes. These attributes specify such diverse aspects of the enterprise as:

a) the nature of the products produced by the enterprise, a description of its plant and equipment, and technology it utilized;

b) a description of its financial states;

c) the place of the enterprise within its industry, including its market share and the nature of its competition;

d) some indication of the risk profile of the firm;

e) the distribution of information within the enterprise;

f) the nature of "measurement errors" in monitoring the performance of the enterprise;

g) the relationship between the enterprise and the state bureaucracy;

h) the "distance" between the enterprise and founding ministry;

i) any potential synergies between the enterprise and some prospective foreign investor.

Phase 3: The enterprise-level negotiation phase

In this phase participants at the participants at the level of each enterprise play an MB game (multilateral bargaining). For each enterprise the structural parameters of the game are included in the characterization of the transition regime to which the enterprise is assigned.

2. The Emergence of Market Economy in European Countries.

2.1. The Transition to a Market Economy

1) The Successes and Failures of Central Planning.

Before considering the transition to a market economy, we must consider the need for such a transition. Today the need is clear: socialist and communist systems have failed to deliver (in a liberal sense) anything like the standard of material advance so often promised.

But more recent rasy assessments of central planning abound. Even as late as 1979 the World Bank published a long and detailed study of Romania – the most Stalinist of the eastern block. The Bank found that from 1950 to 1975 the Romanian economy had grown faster than any other country in the world (9,8 percent per annum). The Bank attributed this startling performance to the fact that government, through its system of central planning, had control of all resources. The Bank forecast a rasy future for Romania – growing at 8,7 percent per capita to 1990. Nor was Romania an aberration. The Bank published in that same year of 1979 a most rasy history of, and prognostication for Yugoslavia. Studies up to 1984 continued to show that central planning, albeit somewhat modified in places, delivered the goods.

This review is not intended to score paints, but simply to remind us of the long addiction of economists to planning and regulation.

2) Transitions

The transition to a market economy always and at all times involves a familiar list of policies.

First is financial stabilization reducing the budget deficit and the monetary emissions of the central bank. This stabilization may involve many complex policies – almost certainly a fax reform and expenditure controls, particularly in the reduction of subsidies. There is no consensus on pegged versus free exchange rates.

Second is deregulation, elimination a myriad of government controls and establishing the framework for free contractual relationships. This priority involves the recognition of property rights and the development of a legal system suitable for a market economy. It also implies a diminished role for the central planners as more room is provided for private initiative and enterprise. But oddly enough it is widely recognized that there is a need for more restraint on industry, particularly the heavy state owned firms, to reduce pollution. Other areas of deregulation include trade reform and currency convertibility.

Third is the reform and privatization of state- owned concerns to this list should be added the reduction in monopoly power not only of industry but also of trade unions, and in particular the reform of labour laws. The reform of the banking system and the development of commercial rather than planning criteria in banking it also of the utmost important.

3) The Political Economy of Transition in Eastern Europe:

Packing Enterprises for Privatization.

An abstract model of the transition from a centralized command economy to a market economy focusing on privatization is a novel orientation for this chapter. In much of the literature on privatization in central and Eastern Europe, either a case is argued for a particular transition proposal or specific aspects of the privatization problem are isolated and considered in detail.

The model focuses on the way in which government policies and enterprise-level decisions are made and relatively less on the specific content of these policies and decisions.

The conceptual model has been designed with five basic premises in mind: multilateral bargaining, political economy, heterogeneity, decentralization, and pluralism.

4) Multilateral bargaining

In a world in which economic rights are ill designed, a bargaining problem naturally arises. Throughout Central and Eastern Europe, this problem can be conceptualized as a multifaceted conflict between multiple interests representing workers, management, claimants to property rights based prior ownership, foreign investors, representatives of different group in the distribution chain, etc.

It is useful to distinguish two different kinds of bargaining problems. There are issues that must be negotiated at the level of central government: for example, what will be the nature the regulatory and legal infrastructure within which these privatized enterprises will operate? Other issues concern the disposition of individual state-owned enterprises and must be negotiated on a case-by-case basis. In particular what will be the precise nature of each corporate entity that is being packaged for sale to private buyers? Who will control it? How will it be structured? What kind of compensation schemes will be in place for management and workers?

What special provisions will be in place that affect the relationship between the privatized entity and other firms, including established and new competitors, firms that are up and down stream in the distribution chain, etc.? In the discussion that follows, the focus will be on bargaining problems of the latter kind. One presumes that, because of the complexity and diversity of the issues during the transition, the state is not in a position to resolve them by fiat rather, over the transition, the state is presumed to be one negotiator among many.

Bargaining problems of this kind can be resolved in a variety of ways. At one extreme, an explicit institutional structure may be established by the state to facilitate an orderly negotiation of the issues. This institution would specify:

a) the interests that should be represented in the bargaining process;

b) the space of issues over which these interests can negotiate;

c) what degree of consensus is sufficient to conclude negotiations;

d) who will represent "the state" the founding ministry are some agency established specially to deal with privatization;

e) what will happen if negotiations break down?

At the other extreme the state may provide no procedural guidelines whatever as to how the issues should be resolved in this procedural vacuum, the economic rights in question may simply be expropriated by whichever party - typically the current management - is strategically located to do so.

Relative to the general trend that appears to be emerging in Central and Eastern Europe, there should be made opportunities for decentralized negotiation.

Our process-oriented perspective does suggest an indirect, "hand off" way to exercise some control over this phase of the process, the government can introduce some checks and balances into the negotiations. For example, of the three "primary" parties at the bargaining table-management, employees of the enterprise, and the state agency responsible for privatization - the first two parties have every incentive to design privatization plans that inhibit competitive pressures, while the third will inevitably be more concerned this effecting a successful sale of the enterprise than with issues such as the competitiveness of the resulting market structure. From the standpoint of the public interest then the outcome of multilateral bargaining is bound to be sub-optimal, provided that participation in the process is restricted to the three primary parties. Moreover, the directions in which these outcomes will deviate from the optimal are more or less predictable.

The Multilateral Bargaining model provides a useful analytical tool for investigating the effectiveness of this approach to policy making.

In other contexts, the multilateral Bargaining model has been used descriptively to explain how during the process of multilateral negotiation, coalitions are formed, deals are struck, and compromises are reached.

5) Political economy.

A second basic premise is that any policy recommendations must be both economically and politically consistent. This consistency requires a specification of the relationship between short-term economic developments and longer-term political ramifications. Obviously, economic policy objectives cannot be pursued in isolation, since the prevailing political configuration will constrain the set of options available to planners of the transition process. On the other hand, economic post-privatization economy develops, new interests will acquire economic power and new institutions will emerge to strengthen the power of groups that wish to defend these institutions. The dynamic interaction between these economic and political facets of massive privatization programs must be taken into account. Indeed, one can expect that models, which ignore political economic feedback effects, will have a natural tendency to overestimate the prospects for a successful transition.

The following example illustrates the kind of political-economic interaction that could adversely affect the reform process. Policy makers in Central and Eastern Europe appear to be overly complacent in their reliance of foreign competition as the main disciplinary device that will force monopolists to operate efficiently. Indeed, Polish officials cite their country’s liberal tradition in the area of trade policy when questioned about the viability of this approach to antimonopoly policy. Our dynamic political-economic perspective leads to skepticism about this heavy dependence on competition from abroad.

If a seems very likely, the post-privatization industrial structure turns out to be highly over-concentrated and inefficient, then the main effect of threatening foreign competition will be to unleash a powerful confluence of political forces in favor of protectionism. Owners of the domestic enterprises will lobby to defend their rents, managers will lobby to defend privileges, and workers will lobby to defend their jobs. Because the problem of unemployment never really arose under communism, the potent tension between introducing free trade and maintaining employment levels never became apparent.

2.2. Poland and Hungary as the best example of transition in the East Europe

Economic Reform in Eastern Europe: The Background

The background of economic reform in Eastern Europe is not unlike that in the Soviet Union, even though, as I have emphasized, the setting is rather different. The brief political thaw following the death of Stalin in the early 1950s did permit a freer discussion of ideas, which, along with growing problems of economic performance, led to limited attempts to develop and implement economic reform. Initially, these changes were modest in scope, and they typically followed the Soviet reform pattern: Try to improve decision making while preserving socialist objectives and the essence of the planning system. This was the focus of the New Economic System in the GDR and of the New Economic Mechanism introduced in Hungary in 1968. The potential for genuine economic reform was certainly limited by Soviet influence. Indeed in some cases (such as Czechoslovakia in 1968), reform was abruptly forestalled by Soviet intervention. In other cases, such as Hungary, reform attempts dating from the late 1960s were sustained on a limited basis, to become the background for more serious reform in the present era. There were, then, numerous attempts at reform in Eastern Europe. What were the major forces promoting these efforts?

First, as was the case in the Soviet Union, rates of economic growth in Eastern Europe have undergone a long-term secular decline. The magnitude of this decline (see Table 1) has varied from case to case, but overall it has been pervasive. Moreover, these countries had taken pride in being high-growth economies, even if the costs, such as little growth of consumer well-being, were also high. At the same time, growth in productivity slackened, especially in the late 1970s and 1980s. And inflation quickened, though it was most serious in Poland and Yugoslavia. Repressed inflation, though difficult to measure, grew in importance in the 1980s.

Second, East European countries relied heavily on foreign trade as a means of stimulating economic growth in the 1970s. Their strategy was to promote exports in Western markets so that the imports required both to stimulate technological change in industry and to enhance consumer well-being could be obtained without the growth of hard-currency debt. Unfortunately, this strategy was not successful. The energy crisis led to a significant slackening of Western markets at the very time when East European nations were becoming more aggressive in these markets. East European imports were sustained, but largely by means of building a substantial hard-currency debt. The magnitude of debt repayment subsequently led to considerable internal belt-tightening for these countries in the 1980s — precisely the opposite of what had been intended.

Third, one could argue that in Eastern Europe, the possibilities for economic growth through extensive means had initially been less promising than in the Soviet case and had been exhausted more quickly. In light of the level of economic development in Eastern Europe compared to that in the Soviet Union, it is not surprising that the imperative for reform was strong and that developments of the Gorbachev era quickly spilled over into Eastern Europe. In the absence of Soviet backing, interest in the administrative command model faded fast.

Table 1. Economic Growth and Performance in Eastern Europe:

The Background to Reform

1961-70 | 1971-80 | 1981-85 | 1985 | 1986 | |

| Eastern Europe | 3.4 | 2.4 | 1.0 | .2 | 2.2 |

| Bulgaria | 5.0 | 2.3 | .1 | -3.2 | 4.7 |

| Czechoslovakia | 2.4 | 2.3 | 1.0 | .4 | 1.9 |

| East Germany | 3.2 | 3.5 | 1.7 | 3.3 | 1.6 |

| Hungary | 3.1 | 2.5 | .6 | -2.3 | 2.4 |

| Poland | 3.3 | 3.0 | 1.0 | .2 | 2.1 |

| Romania | 4.2 | 3.5 | -.6 | -1.4 | 3.1 |

East European Reform Programs: Similarities and Differences

In this chapter we pay special attention to Poland and Hungary. We do so because these countries are both examples of aggressive reform but have employed different strategies. However, before we consider these cases in greater detail, it is useful to summarize the East European reform experience, noting important similarities and differences among the various cases. To do so will entail some repetition of basic themes.

First, economic reform in Eastern Europe (at least in Poland, Hungary, and Czechoslovakia) is generally described as a transition in that these countries seek to replace the planned economy with a market economy rather than attempting merely to modify the former.

Second, transition programs have varied in speed and intensity. Some countries have pursued reform on a "gradual" basis, whereas others, like Poland, have pursued what is often termed a "big bang," or rapid, approach to reform. However, we must remember that even in those countries not pursuing a "big bang" or "shock therapy" approach, the process of transition in Eastern Europe has been relatively rapid, especially when compared to reforms of the past - and notably so when compared to the recent Soviet record. It is important, therefore, to be aware of the basic issues associated with transition and of the extent to which the attempted speed of transition alters the overall reform experience.

Third, although it is possible to examine and understand the basic elements of economic reform and even of transition from one system to another, we really do not have a general theory of change in economic systems. In some cases — for example, during such a period of rapid change as the 1990s — it is difficult even to develop a way to classify the issues involved in transition.

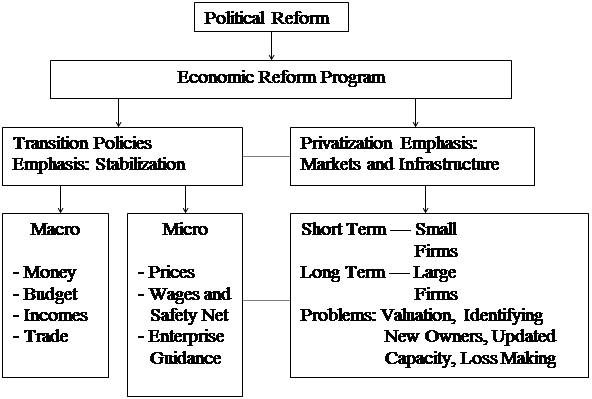

Fourth, important differences exist from one country to another. Our view of the socialist transition process is heavily influenced by our image of the best-known and most advanced reforms, such as those of Poland, Hungary, and Czechoslovakia. We know much less about, and tend to pay less attention to developments where reforms are proceeding at a slower pace, as in Romania and Bulgaria. Figure 1 offers a simple, stylized view of contemporary political and economic reform (transition) in Eastern Europe.

Figure 1. Reform in Eastern Europe